Limited Edition1

Singapore’s most generous2 rebate card

The one and only card that gives you more when you spend.

- Up to 5% cash rebate3 on all spend

- Up to 3.33% cash rebate3 for spend below S$2,000

- Up to 3.33% interest p.a.4 on your savings in UOB One Account

- Up to 23.1% at Caltex and 24% at SPC5

- Up to 20% SMART$ rebate at over 800 participating merchants

Apply now and get your limited edition card1 and up to S$80 cash credit6!

Up to 5% cash rebate on all spend3

Including recurring bill payments and 0% instalment payment plans.

If your UOB One Card statement date is the 15th of every month, a minimum of 3 purchases with a combined minimum spend must be posted before the statement date for you to earn the quarterly cash rebate.

Minimum Monthly Spend for 3 Consecutive Months

Cash Rebate

Higher interest rate of up to 3.33% p.a.4 on your savings

Earn higher interest on your UOB One Account savings with a min. S$500 spend every calendar month on your UOB One Card.

| First

S$10,000 |

Next

S$20,000 |

Next

S$20,000 |

Above

S$50,000 |

|

| Spend S$500

on your UOB One Card |

1% p.a. | 1.5% p.a. | 2% p.a. | 0.05% p.a. |

|

Spend S$500

on your UOB One Card + Credit your salary or Perform 3 GIRO transactions |

1.5% p.a. | 2% p.a. | 3.33% p.a. | 0.05% p.a. |

Additional Rebate with UOB SMART$ Rebate Programme

Get up to 20% instant SMART$ rebate which you can use to offset your next purchase at over 800 participating merchants like:

| SMART Merchants | Rebate |

| Genufood Enzymes | 20% |

| The Coffee Bean & Tea Leaf | 10% |

| BreadTalk | 3% |

| EpiCentre | 3% |

| Sephora | 3% |

| Cold Storage, Market place, Jasons, Giant | 0.5% |

| SMART Merchants | Rebate |

| Cathay Cineplexes | 2% |

| Caltex | 2% |

| World of Sports | 2% |

| Metro | 2% |

| United Overseas Insurance | 5% |

| Guardian | 0.5% |

Visit uob.com.sg/smart for the full list of merchants.

Eligibility and Fees

21 years old

Minimum Age

S$30,000

Minimum Income

S$40,000

Minimum Income

S$10,000

Fixed deposits

S$10,000

Fixed deposits

S$128.40

PRINCIPAL CARD ANNUAL FEE (First year card fee waiver)

Fees are inclusive of Singapore’s prevailing Goods and Services Tax (GST)

Not the card for you? One of these might suit you better

UOB Lady’s Platinum Card

The men don’t get it.

5X UNI$

5X UNI$

UOB Lady’s LuxePay Plan

UOB Lady's LuxePay Plan.

Shop for the shoes and bags you have always wanted with absolute financial freedom. With the UOB Lady’s LuxePay Plan, you can shop anywhere in Singapore, overseas and online, and convert any shoes and bag purchases worth S$500 or more into a 6 or 12-month instalment plan, absolutely free!

Eligibility and Fees

Exclusively for ladies.

21 Years old

Minimum Age

S$30,000

Minimum Income

S$40,000

Minimum Income

S$10,000

Fixed deposits

S$10,000

Fixed deposits

S$192.60

PRINCIPAL CARD ANNUAL FEE (First year card fee waiver)

Fees are inclusive of Singapore’s prevailing Goods and Services Tax (GST)

Not the card for you? One of these might suit you better

Save up to S$600 per year

| Merchants | Rebate | Monthly spend in a calendar month | Savings in SMART$

(1 SMART$ = S$1) |

| Cold Storage/ Market Place/ Jasons/ Giant/ Guardian | 8% | S$500 | S$40.00 |

Purchases made via

|

3% | S$300 | S$9.00 |

| Other spend

(E.g. Dining, Shopping, Petrol, Overseas, etc) |

0.3% | S$100 | $0.30 |

| Total spend | S$900 | - | |

| Monthly Savings | - | $49.30 | |

| Yearly Savings | - | $591.60 |

Redeem your SMART$ instantly at over 800 merchant outlets island-wide including Cold Storage, Market Place, Jasons, Giant and Guardian.

Figures in the table are for illustration purpose only.

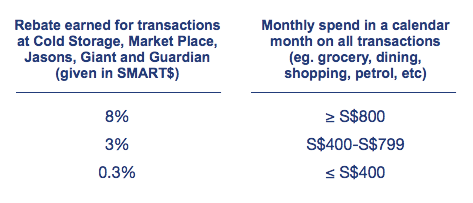

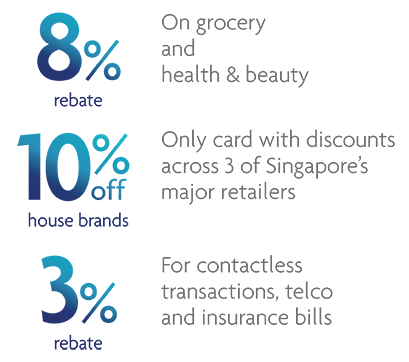

Earn up to 8% rebate

Find out your monthly SMART$ rebate based on your average monthly local spend.

Up to 8% rebate

when you shop at Cold Storage,

Marketplace, Jasons and more

S$0

Up to 3% rebate

For all contactless transaction* and selected recurring bills^

S$0

0.3% rebate

on all other spends

S$0

Rebate will be capped at 50 SMART$

per Cardmember.

*Valid for Visa payWave and NETS FlashPay Auto Top-up transactions

^Valid for Singtel, M1, Starhub, Pacnet, Prudential Insurance, United Overseas Insurance, Town Councils and SPH newspapers monthly recurring bills

Click here for details.

Eligibility and Fees

21 Years old

Minimum Age

S$30,000

Minimum Income

S$40,000

Minimum Income

S$10,000

Fixed deposits

S$10,000

Fixed deposits

S$85.60

PRINCIPAL CARD ANNUAL FEE (First year card fee waiver)

Fees are inclusive of Singapore’s prevailing Goods and Services Tax (GST)

Not the card for you? One of these might suit you better