PRUwealth

Grow your savings, surely and securely

In this environment of rising costs and inflationary pressures, wouldn't it be ideal if your savings continue to earn healthy returns and counter the impact of inflation in the long term?

PRUwealth allows you to do just that1. PRUwealth ensures that your capital remains intact in the long term after the 20th year1, while giving you potentially higher returns. Best of all, you will see real growth in your PRUwealth plan without having to worry about market volatility1.

key benefits

How it works

How PRUwealth works:

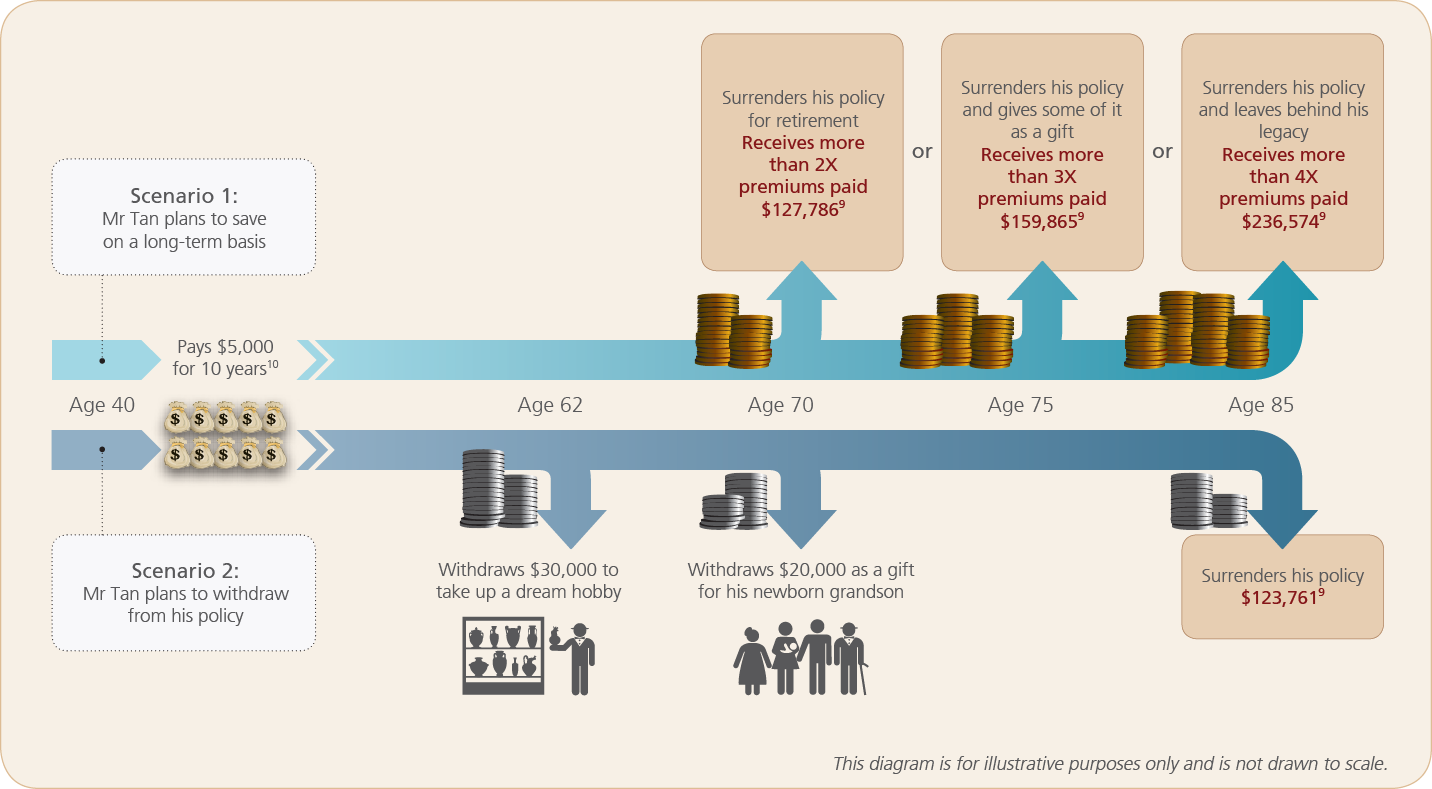

Mr Tan (male, non-smoker), age 40 next birthday, wants to start a long-term insurance savings plan by setting aside S$5,000 per year for 10 years10, and also wants to have the option of withdrawing4, some portion of his money whenever there is a need.

Scenario 1:

How PRUwealth works if Mr Tan plans to save on a long-term basis

Mr Tan chooses to accumulate his savings without making any withdrawals, so he could have more when he decides to surrender his policy at a later age. He will get S$127,7869 (more than 2X of his premiums paid) at age 70, S$159,8659 (more than 3X of his premiums paid) at age 75, or S$236,5749 (more than 4X of his premiums paid) at age 85 when he chooses to surrender the plan.

Scenario 2:

How PRUwealth works if Mr Tan plans to withdraw from his policy

At age 62, Mr Tan plans to withdraw S$30,000 to celebrate the start of his retirement by taking up a dream hobby. At age 70, he decides to withdraw another S$20,000 as a gift for his newborn grandson. He then decides to surrender his policy at age 85 so that he can pass his savings to his loved ones, and the surrender value for his policy will be S$123,7619.

USEFUL VIDEOS