-

Security

-

Q5. What is your security policy?We are committed to meeting and exceeding all industry standards. Protecting your transaction is our job and we take it very seriously.

Contactless Cash Withdrawal from a Contactless ATM is as secured as using your physical ATM card. You will still be required to enter your Card Pin on the ATM Pin Pad. As an added layer of security, for the Contactless ATM to recognise your card, you have to unlock the ApplePayTM wallet with your fingerprint or passcode (dependent on what you have set up on your device).

-

-

Withdrawing Cash

-

Q6. How do I get started?You will first need to add your UOB MasterCard Debit or Credit Card on ApplePay™.

Get step by step instructions to add your card on ApplePay™.

After which, at the Contactless ATM,- Select your UOB MasterCard Debit or Credit Card on ApplePay™.

- Hold your device over the contactless symbol on the ATM, and access the card in your ApplePay™ wallet with Touch ID.

- Enter your Card Pin at the ATM key pad to start your transaction.

-

Q7. What are the services that are supported on the Contactless ATM?Currently, only cash withdrawal is supported.

To access the rest of the ATM services, you may use your physical card. -

Q8. What is the withdrawal limit for Contactless Cash Withdrawal?The withdrawal limit is the same as your physical card.

-

Q9. Is Contactless Cash Withdrawal considered a cash advance transaction?No. A cash withdrawal using an added credit card on ApplePay™ is not considered a cash advance transaction. That is the reason why you will need to link your UOB MasterCard Credit Card to a current or saving account.

Visit the nearest branch to link your UOB MasterCard Credit Card to current or savings account. -

Q10. How can I check my balances after a cash withdrawal?After your cash withdrawal from the Contactless ATM, you may choose to display your account balance on the ATM screen or via a printed receipt.

You can also view the cash withdrawal transaction via UOB Mighty or Personal Internet Banking in the history of the linked current or saving account. -

Q11. Will I receive transaction alerts through SMS or email for cash withdrawal from Contactless ATM?Yes. You will receive transaction alerts based on your current setting on ATM cash withdrawal threshold.

To change the threshold to receive transaction alerts, sign in to Personal Internet Banking.

-

Contactless Cash Withdrawal

Contactless Cash Withdrawal

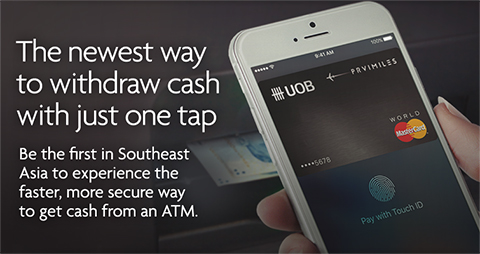

UOB is the first and only bank in Southeast Asia to launch the Near Field Communication (NFC) contactless Automated Teller Machine (ATM). This means our customers will be able to withdraw cash simply with the tap of their compatible mobile devices at selected ATMs.Added Convenience

Withdraw cash with just your mobile device.

Improved Security

Unlock wallet, tap and key in your ATM PIN.

Get started

You'll need a UOB MasterCard Credit or Debit Card added on Apple Pay™. Find out how

At the ATM

Withdraw cash with your mobile device.

Select your UOB MasterCard Credit or Debit Card on Apple Pay™.

Hold your device over the contactless symbol on the ATM, and access the card in your wallet with Touch ID.

Enter your ATM PIN at the ATM and start your transaction.

You'll need to link your UOB MasterCard Credit Card to your Current or Savings Account first. To link it, just visit any UOB branch.

Compatible Cards

Now available with Apple Pay™ and the following UOB MasterCard Credit or Debit Cards:

Don't have a UOB MasterCard Credit or Debit Card?

Click on the cards above to find out more and to apply.

Complete the online application form and upload the required documents to us before 1pm*.

Important note:

- Same-day card delivery is only applicable to Credit Card applications submitted at uob.com.sg with complete application form and documents before 1pm, Mon-Fri (excluding Public Holidays).

- For applications submitted on Sat and Sun opting for same-day card delivery, card will be delivered by the following Tues (excluding Public Holiday).

-

Same-day card delivery service is not applicable to:

- Incomplete applications pending documentation/information;

- Existing UOB customers holding a different NRIC/Passport/PR number per bank records;

- SMS application;

- Contact form and Acceptance form submissions.

Apple Pay™ terms and conditions apply. View here.