Online Security

Online Security

It’s safe to bank online with UOB. Enjoy the full convenience of secure online banking transactions with our multi-layered security programme. Learn more about how we keep your transactions safe.

provides additional

security authentication

UOB uses the SecurePlus token which uses Two-Factor Authentication (2FA). You will be prompted to enter a unique One-Time Password which can be retrieved from your SecurePlus token for your online transactions.

your account safe

Multiple levels of firewalls act as a barrier between the bank system and Internet to protect your account and personal information.

We protect the confidentiality of your account details and transaction data. Our 128-bit Secure Sockets Layer (SSL) encryption protects your information as you complete your online transactions.

Only by using your unique Username and Password can you log on to our secure website(s) to perform your transactions.

You will be logged out of your Internet banking session after a period of inactivity to ensure that your account and details are not compromised.

If you suspect that your account has been compromised, please change your password and contact us immediately by calling

(24 hours, toll-free)

Top Security Tips

When it comes to keeping your account secure, your role as an online banking user is just as important as ours. You may consider adopting these best practices to keep your account safe.

Keep your password confidential at all times and do not divulge it to anyone.

Do not use personal information such as your telephone number, birth date or the like as your password as these will not make strong passwords.

Change your password regularly.

Change your password immediately if you suspect your account has been compromised.

Always use a mobile device or computer that you trust.

Always log out after an online banking session.

Always clear your cache after your online banking session before moving to another website.

Install and maintain the latest anti-virus software on your mobile device or computer.

Use operating systems and browsers that are up to date.

Type in the URL of UOB website directly into your browser.

Do not key in your username, password, mobile number or OTP into suspicious websites or mobile apps.

Check your statements regularly.

Contact the bank immediately when you suspect your account has been compromised.

Latest Online Threats

Online threats come in various forms and are constantly evolving. With a better understanding of the latest threats, you can stay well informed on how to keep your finances safe.

There have been reports of phone scams where individuals have received automated voice calls requesting them to enter numbers on their phones which will then connect them to a “telephone operator” or “bank employee”.

From there, the “telephone operator” or “bank employee” may request for personal information, and then transfer their call to another person who may claim to be a “police officer”. Individuals may then be instructed to submit confidential information such as bank account numbers, internet banking usernames, passwords and One Time Passwords (OTPs) on a website.

Using the information acquired, the perpetrator will then initiate a funds transfer to an overseas bank account.

- Be alert. Do not provide any personal information, bank account information (including user ID, password and OTP) and credit card details on websites or with the callers.

- Be safe. Do not transfer any money.

- Inform the bank. If you are unsure of the call you have received, or have inadvertently disclosed your personal or bank information, please call the bank immediately at 1800 222 2121.

- If in doubt, please also call 999 for police assistance.

These SMS messages contain a phone contact for interested individuals to call. If the individual calls that number, the perpetrator will attempt to get him or her to disclose confidential information such as bank account numbers, internet banking usernames, passwords and One Time Passwords (OTPs), which will then be used to initiate a funds transfer out of the individual’s bank account.

- Be alert. Do not provide any personal information, bank account information (including user ID, password and OTP) and credit card details on websites or with the callers.

- Be safe. Do not transfer any money.

- Inform the bank. If you are unsure of the call you have received, or have inadvertently disclosed your personal or bank information, please call the bank immediately at 1800 222 2121.

- If in doubt, please also call 999 for police assistance.

For more information on such scams, please visit: http://www.scamalert.sg/types-of-scams/impersonation-scam

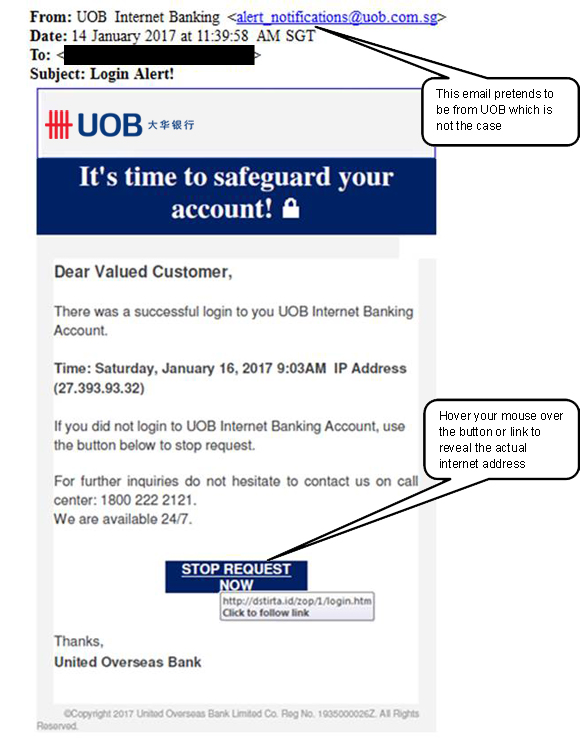

This malware is spread through phishing emails with malicious attachment. When the said malicious attachment is opened, the malware infects the customers' computers or devices. Once customers' computers or devices are infected, the malware will attempt to steal the customers' login and authorisation credentials (such as User ID, Password, One Time Password) by altering the flow of logging on to the UOB website. After the first login page, it will show a message "We are currently processing your information, please wait...." which does not exist in the legitimate UOB website.

- Prompt to input your login credential multiple times even if your supplied information is correct.

- Sudden slowness in your computer and/or requests you to wait while the system is processing for an extended time.

- Unusual logon/authorisation procedures and/or re-direct to the unfamiliar website.

- Always protect your computer by using an anti-virus/anti-malware software and keep it updated with the latest anti-virus. Scan your computers regularly.

- Do not download or open attachments in suspicious emails.

- Never reply to unsolicited emails.

- Avoid accessing unknown and unsecured websites.

- If you suspect that your computer has been infected by malware, please scan your computer with latest anti-virus/anti-malware software and refrain from using banking websites until your computer is cleaned.

- Check your last login and transaction history regularly for any abnormal transactions.

In view of this vulnerability, we will not be supporting older versions of web browsers as of 21/11/2014.

We recommend customers to download and install the latest versions of your web browsers to ensure optimal user experience.

UOB would like to encourage our customers to take the following steps to safeguard your passwords for a safe and secure online banking experience.

- Use a username and password for your online banking account(s) that is different from other non-banking related accounts.

- Select a password that is at least eight characters long, contains alphanumeric characters and does not have any repeated characters.

- Change your passwords regularly, at least once every three months.

Disable the “Auto Complete” function on your web browser to avoid theft of information. - Do not disclose your username or password to anyone.

UOB would like to use this opportunity to encourage our customers to adopt the following best practices to safeguard their passwords for a safe and secure online banking experience. Customers should:

- Use a different username and password for their online banking accounts from other non-banking related accounts.

- Select a password that is at least eight characters long, contains alphanumeric characters and does not repeat any character.

- Change their passwords regularly, at least once every three months.

- Not reveal their account username or password to anyone.

- Disable the “Auto Complete” function on the browser to avoid theft of information.

If you encounter any suspicious activities in relation to your account(s), please contact us at 1800 222 2121.

Mobile Security

Even as you enjoy the convenience of banking on the go, it’s important to keep your account safe. Read more about our security and privacy policies and how to safeguard your mobile banking activities today.

We are committed to meeting and exceeding all industry standards. Protecting your information is our job, and we take it very seriously. Find out how we protect you or take a look at our security policies.

We are committed to maintaining the highest standard on privacy practices. We and our partners will never sell, rent or loan any personal information that you share with us.

We will never request for your password or PIN over the phone, email or SMS. Your password and PIN are private to you – Never reveal them to anyone.

If you notice something amiss, you can call our customer hotline at 1800 222 2121 (Calling from local) or (65) 6222 2121 (Calling from overseas) to block your digitised card right away.

If your mobile device is lost or stolen, your liability will be limited to S$100.00 but only if you take all of the following steps:

- You immediately notify us of the loss or theft of your mobile device or the disclosure of your wallet PIN;

- You take all reasonable steps to help recover or stop the use of the digitised card(s) and wallet PIN;

- You give us a police report or a legal document called a statutory declaration in the form approved by us and any other document or information we require; and

- You have established, and we are satisfied that, you have not by your acts or omissions (directly or indirectly) caused or contributed to the occurrence of the loss, theft or disclosure of the wallet PIN and the loss, theft of your mobile device or disclosure of the wallet PIN is not due to your negligence, fraudulent act or default.

Enhanced Security

- Add new payee

- Change of personal particulars and address

- Change of UniAlerts Subscriptions

- Change of funds transfer, bill payment or remittance transaction limits

- Change of One-time Password (OTP) settings

- Transactions with amount higher than the OTP threshold1

To activate:

- Login to UOB Personal Internet Banking or UOB Mighty

- Select Activate Now button

- Follow on-screen instructions to activate

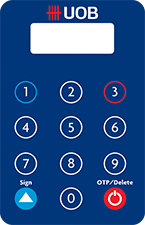

The SecurePlus token allows you to generate a secure One-time Password (OTP). This OTP is nessasary for login and to perform selected UOB Personal Internet Banking and UOB Mighty transactions.

Generate OTP:

Press and hold ![]() to generate a One-time Password

to generate a One-time Password

The ![]() button icon design may differ for some tokens.

button icon design may differ for some tokens.

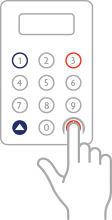

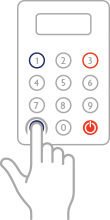

Transaction Signing uses transaction-specific information to generate an OTP, thus providing you with greater security.

Transaction Sign:

- Press and hold

to begin

to begin - Enter transaction-specific data using the keypad, as instructed on your internet banking screen

- Press and hold

a second time to obtain OTP

a second time to obtain OTP

The ![]() button icon design may differ for some tokens.

button icon design may differ for some tokens.

Convenient Updates

Cardholders with UOB ATM Cards, UOB Debit Cards and UOB Credit Cards linked to their Current/Savings accounts will receive an SMS alert when a local ATM cash withdrawal at or above a default threshold amount is made.

Cardholders with UOB ATM Cards, UOB Debit Cards and UOB Credit Cards linked to their Current/Savings accounts will receive an SMS alert when an overseas ATM cash withdrawal at or above a default threshold amount is made.

Alerts you when a funds transfer transaction at or above your default threshold amount is made from your account to an OCBC account at an UOB ATM.

Alerts you when a NETS payment at or above your default threshold amount has been debited from your account.

Alerts you when any cheque payment and encashment at or above your default threshold amount.Local ATM Cash Withdrawal.

Cardholders with UOB ATM Cards, UOB Debit Cards and UOB Credit Cards linked to their Current/Savings accounts will receive an SMS alert when a local ATM cash withdrawal at or above a default threshold amount is made.

Alerts you when a bill payment at or above your default threshold amount is made from your account.

Alerts you when a funds transfer transaction at or above your default threshold amount is made from your account.

Alerts you when online transactions for Cashier’s Orders, Demand Drafts and Telegraphic Transfers at or above your default threshold amount are made from your account.

Alerts you when an eNets transaction at or above your default threshold amount is made from your account.

Alerts you when a Mobile Cash transaction is sent from your account and notifies you when your Mobile Cash recipient receives the Cash.

Alerts you when your GIRO application is approved. You’ll also receive alerts 3 working days before an upcoming GIRO Standing Instruction payment is due from your account.

Alerts you on the status of your IPO and Unit Trust applications made through UOB Personal Internet Banking.

Alerts you when a transaction* charged to your UOB Credit/Debit Card is at or above the default threshold amount set by UOB.

Alerts you 3 working days before a scheduled Cash Advance transfer is made via UOB Personal Internet Banking.

Alerts you when your UOB Credit Card bill payment has been received by the bank.

Alerts you 7 working days before the due date of your UOB Credit Card payment.

Alerts you when your total available credit is low.

All customers are automatically subscribed to UniAlerts for ATM Cash Withdrawals locally and overseas. To subscribe to all other UniAlerts, please log in to UOB Personal Internet Banking (PIB) and click on Account Services > Manage Alerts.

Here's how you can change your UniAlerts default threshold amounts:

- For UOB PIB customers, simply login to UOB Personal Internet Banking in 2FA (SMS or Token-OTP) mode, click on Account Services > Manage Alerts.

- For non-PIB customers, you can click here to apply for PIB access and change your default threshold amounts through Account Services > Manage Alerts. Or complete this form to change your default threshold amounts for ATM & Other Banking Services and submit it at any UOB branch.

- To update your registered mobile phone number with us, please complete this form and submit it at any UOB branch.

Read our Frequently Asked Questions (FAQ) for more information.