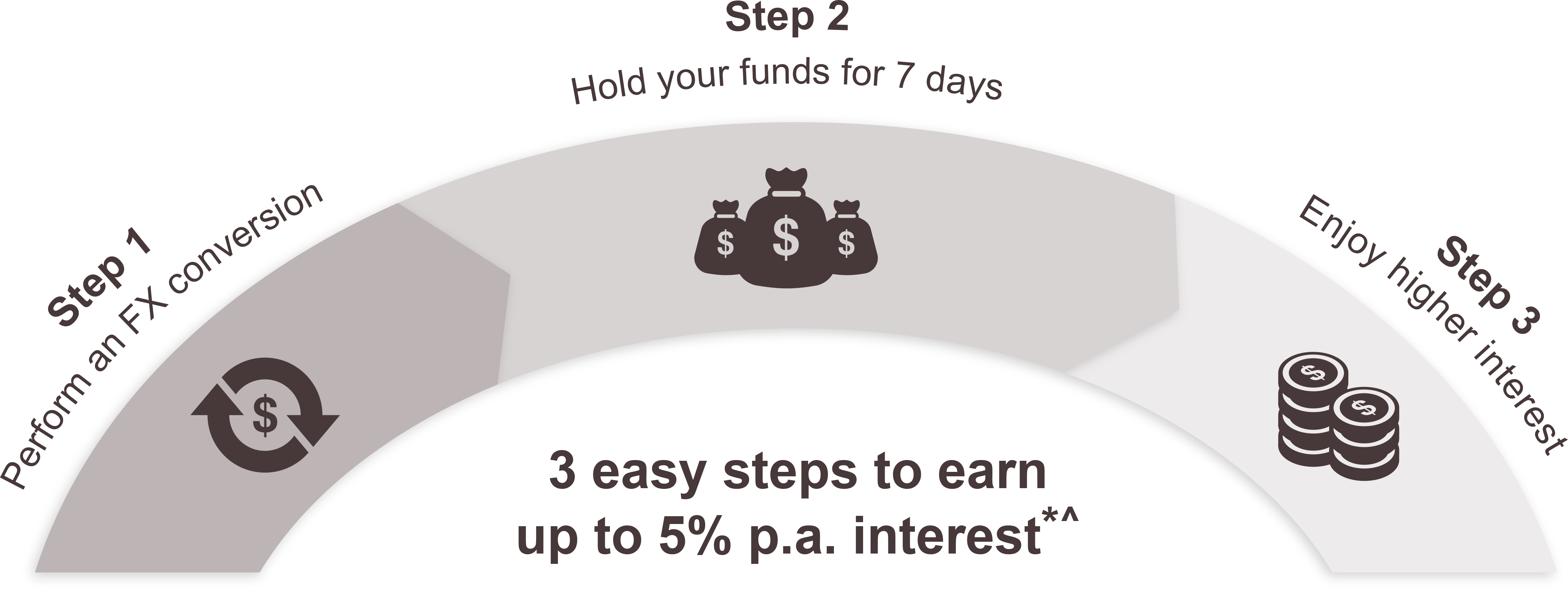

How it works

Grow your wealth from competitive interest rates when you perform an FX conversion with us. Available in 6 popular currencies, you can earn potentially greater returns with up to 5% p.a. interest for 7 days.*^

Benefits

- Preferential exchange rates on SGD, USD, AUD, GBP, NZD, CAD pairings

- Higher interest rates for 7 days

Currencies

| Currency | Minimum Placement (in respective currency) |

| SGD | 150,000 |

| USD | 100,000 |

| AUD | 150,000 |

| GBP | 80,000 |

| NZD | 150,000 |

| CAD | 150,000 |

|

UOB Fixed Deposit Earn 5% p.a. for 7-days on all currencies* |

|

UOB Global Currency Premium Account (GCPA) Earn up to 5% p.a. for 7-days on all currencies (except SGD)^ |

Note:

1. The Global Currency Premium Account must not be currently tagged with any promotional / retention rates.

2. The said account will not be eligible to participate in any Global Currency Premium Account promotion within the same month.

* Full terms and conditions governing the UOB High Rate 7 Day FD Foreign Exchange Promotion (1 November 2017 to 31 January 2018) apply and are available here.

^ Full terms and conditions governing the UOB Global Currency Premium Account 7 Days Blitz Promotion (15 November 2017 to 31 January 2018) apply and are available at here.

Foreign Currency Investments:

There are inherent risks involved in any investment, such as foreign exchange risk, sovereign risk and interest rate fluctuations. Adverse foreign exchange rate movements could erase your deposit interest earnings completely or reduce the original capital amount. The value of your redemption amount/returns on deposits at maturity may be less than your principal investment amount on conversion if the prevailing exchange rate moves against your favour. Exchange controls may also apply from time to time to certain foreign currencies that may affect the convertibility or transferability of that currency.

Deposit Insurance Scheme:

Singapore dollar deposits of non-bank depositors and monies and deposits denominated in Singapore dollars under the Supplementary Retirement Scheme are insured by the Singapore Deposit Insurance Corporation, for up to S$50,000 in aggregate per depositor per Scheme member by law. Monies and deposits denominated in Singapore dollars under the CPF Investment Scheme and CPF Retirement Sum Scheme are aggregated and separately insured up to S$50,000 for each depositor per Scheme member. Foreign currency deposits, dual currency investments, structured deposits and other investment products are not insured.