Wait no more.

Waiting is frustrating for everyone. Now, that’s a thing of the past with UOB Cards.

Apply now and get up to S$120* at over 200 merchants and outlets.

![]()

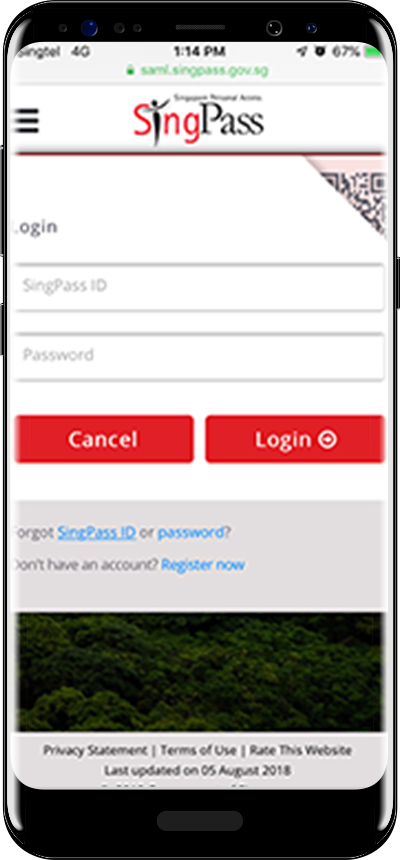

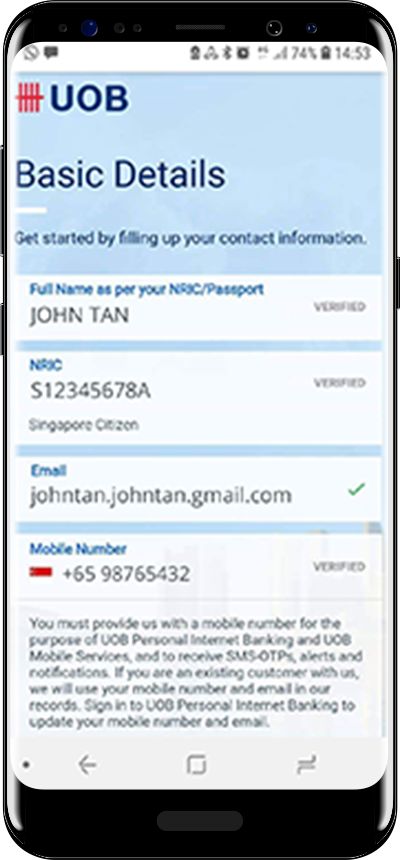

For new-to-bank customers, the process has been enhanced to be fast, simple, and secure with MyInfo.

No more endless fields to fill in and documents to upload.

Fast application,

within 2-3 minutes.

Less fields to fill in and no documents to upload^.

Real-time approval,

via SMS.

Card can be digitised for contactless payments immediately.

Apply now and get up to S$120* at over 200 merchants and outlets, including:

Add your debit or credit card by signing in or manually keying in your Debit, Credit or ATM Card details.

Read and accept the Terms & Conditions.

Set your wallet pin.

Key in your SMS One-Time Password and your card is successfully added!

FAQs

Only New-to-Bank applicants that use MyInfo to retrieve personal details and income information (CPF and Notice of Tax Assessment information), pass all screening steps and income checks are eligible for Instant Account Opening. The application must be submitted after 7am and before 8pm. Applicants will receive a SMS notification to inform them that the Credit Card/Cashplus application(s) has/have been approved within minutes from submission.

For Credit Card applicants, they can instantly sign in to Mighty (Android version only) to digitise their credit card.

Please allow 3-5 working days for processing if you are:-

- an existing-to-bank applicant using PWEB (MyInfo) or have chosen the manual form filling route;

- a new-to-bank applicant that failed any one of the screening steps or income checks;

- a new to-bank applicant that applied from 8pm to 7am;

Applications not accompanied by the required documents or with incomplete information will cause a delay in processing.

MyInfo is a consent-based personal data platform for SingPass users to manage the use of their data for online account opening/ transactions with participating government agencies and commercial entities. By using MyInfo, Singapore citizens/PRs can skip filling in personal data repeatedly for every electronic transaction, and enjoy greater conveniences like submitting fewer verification documents. All SingPass account holders (Singaporeans and PRs) will have their profiles enabled in MyInfo. For more information, visit www.myinfo.gov.sg.

UOB is embarking on MyInfo integration to simplify opening of new bank accounts and will be using it to update personal details or to provide the bank with income information.

You do not need to create a MyInfo profile as all users (Singaporean and PR) with a SingPass account will be auto-enrolled for MyInfo. For first time users, consent from you will be required to enable UOB to pull your data from government agencies from MyInfo.

You can register for a Singpass account via https://www.singpass.gov.sg/singpass/register/instructions

- support@myinfo.gov.sg or

- +65 6643 0567

- Mon - Fri: 8.00am to 8.00pm

- Sat: 8.00am to 2.00pm

- Sun and Public Holiday: Closed

Your MyInfo profile contains personal data as registered with various participating Government agencies. Please contact the relevant source agency or MyInfo if any field is incorrect (you may refer to the tooltip of each corresponding field for additional details).

You will be notified via SMS and a notification letter will also be mailed to you.

For Android device users, you can digitise your new credit card in UOB Mighty Pay with your newly created Internet Banking credentials.

For Apple device users, you can add your new credit card in Apple Pay when you receive your physical credit card.

Once the new credit card is added in UOB Mighty Pay or Apple Pay, you can pay with a tap at over 50,000 Visa payWave, MasterCard contactless and NETS contactless terminals in Singapore.

For more details and the step-by-step guide, visit uob.com.sg/instant.

Customers who select same day delivery for their physical card

Your physical card is in transit by post and UOB has enabled a security feature to restrict digitisation of the Card. Once you have received the physical card and activated it, you will be able to digitise your card to make contactless payments.

^Apply & Pay within minutes is only valid for New-to-Bank applicants who use MyInfo to retrieve personal details and income information, pass all screening steps and income checks. Applications must be submitted from 7am - 8pm.

*S$100 Rebate for Card Application: Limited to the first 1,000 qualifying new-to-UOB Principal Credit Cardmembers or new-to-KrisFlyer Debit Cardmembers who spend a minimum of S$1,000 within the first 30 days of their new card approval. S$20 Rebate / Voucher for Card Application: Limited to the first 2,000 qualifying new-to-UOB Principal Credit Cardmembers or new-to-Krisflyer Debit Cardmembers who make their first transaction at selected merchants within the first 30 days of card approval. Valid from 17 October – 31 December 2018. Full terms and conditions apply, please click here.