You've spent your life accumulating your wealth.

It is now time to unlock the potential of your wealth not just by preserving your capital, but also plan to transfer it in the most efficient way to the people that matter most to you.

You can do so through 3 simple solutions - Multiply, Safeguard and Distribute.

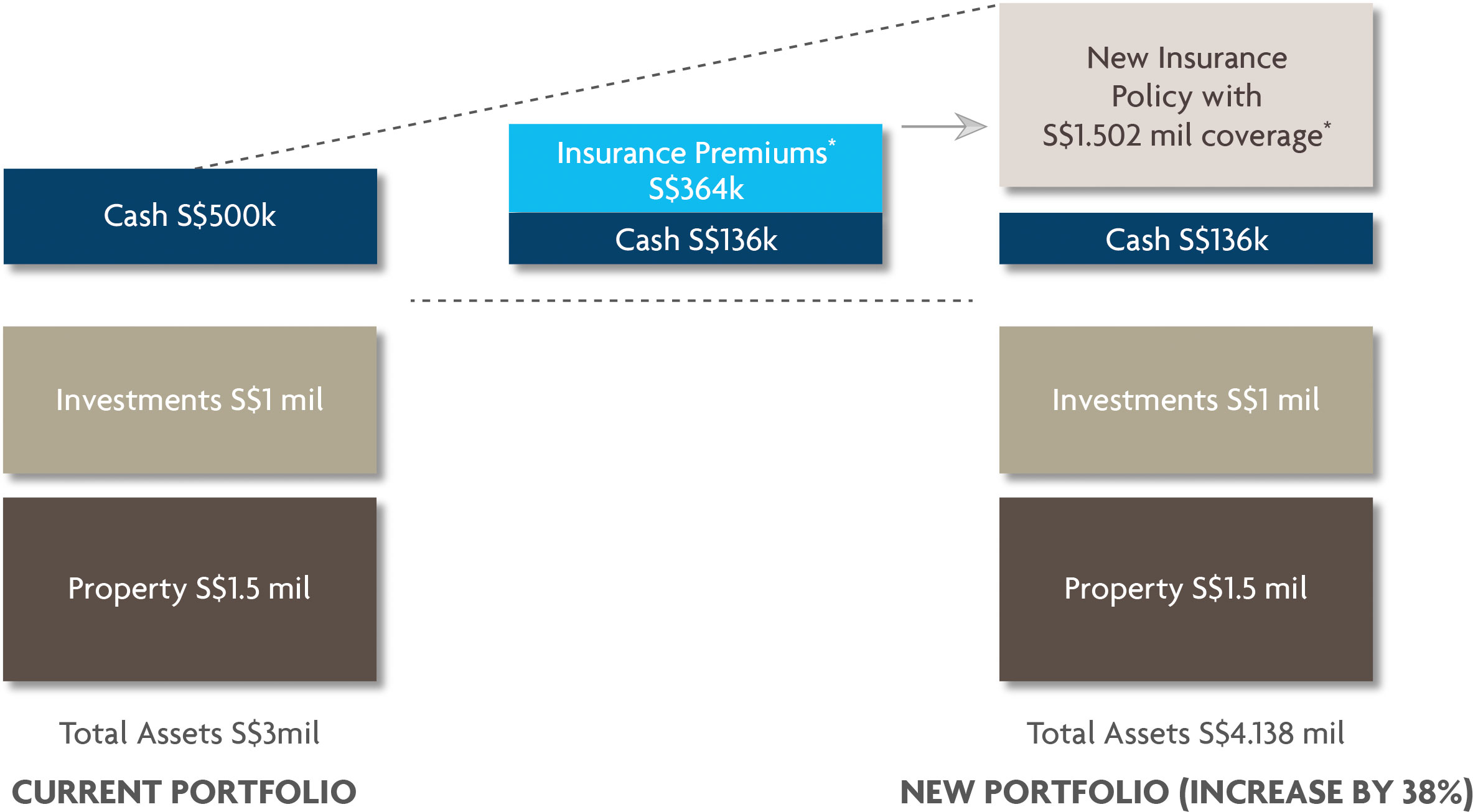

UOB's solution for Mr Chan

With proper planning, Mr Chan can multiply S$364k cash into S$1.5 mil worth of protection for his family, and at the same time enjoy his life the way he wants.

*Insurance premium quoted is based on PruLife Vantage Achiever II (SGD) for Male, Age 45 and Non-smoker. Figures provided above are for illustrative purposes only. Policy terms and conditions apply.

Suitable for:

Individuals looking to create additional estate to leave behind for their dependants, without having to compromise on their current and desired future lifestyle.

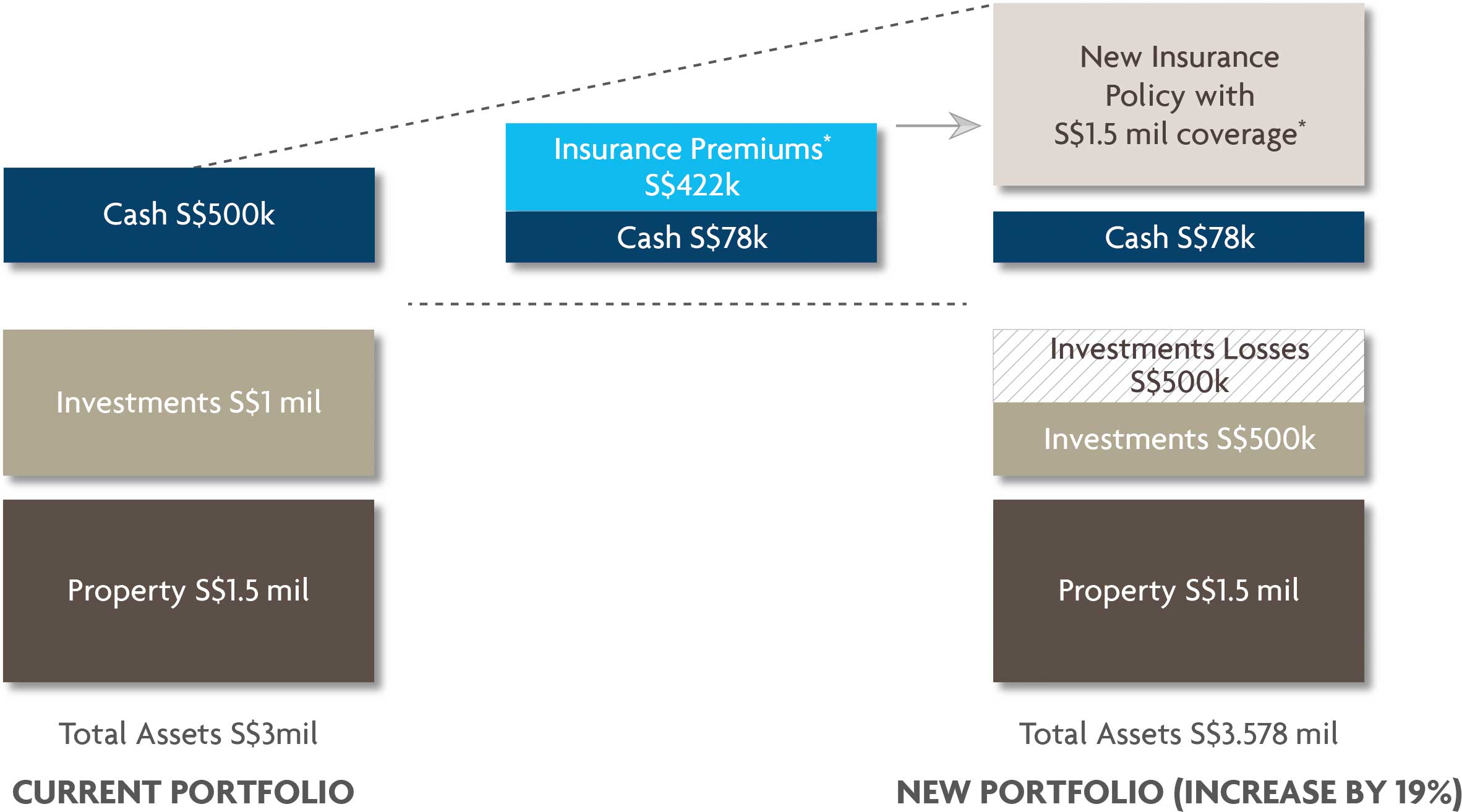

UOB's solution for Mr Wong

Mr Wong can safeguard the funds he wants to set aside for his loved ones without worrying about his future investment portfolio value.

*Insurance premium quoted is based on PruLife Vantage Achiever II (SGD) for Male, Age 50 and Non-smoker. Figures provided above are for illustrative purposes only. Policy terms and conditions apply.

Suitable for:

Individuals who wish to provide additional protection for their family, without having to liquidate existing assets during times of unforeseen circumstances.

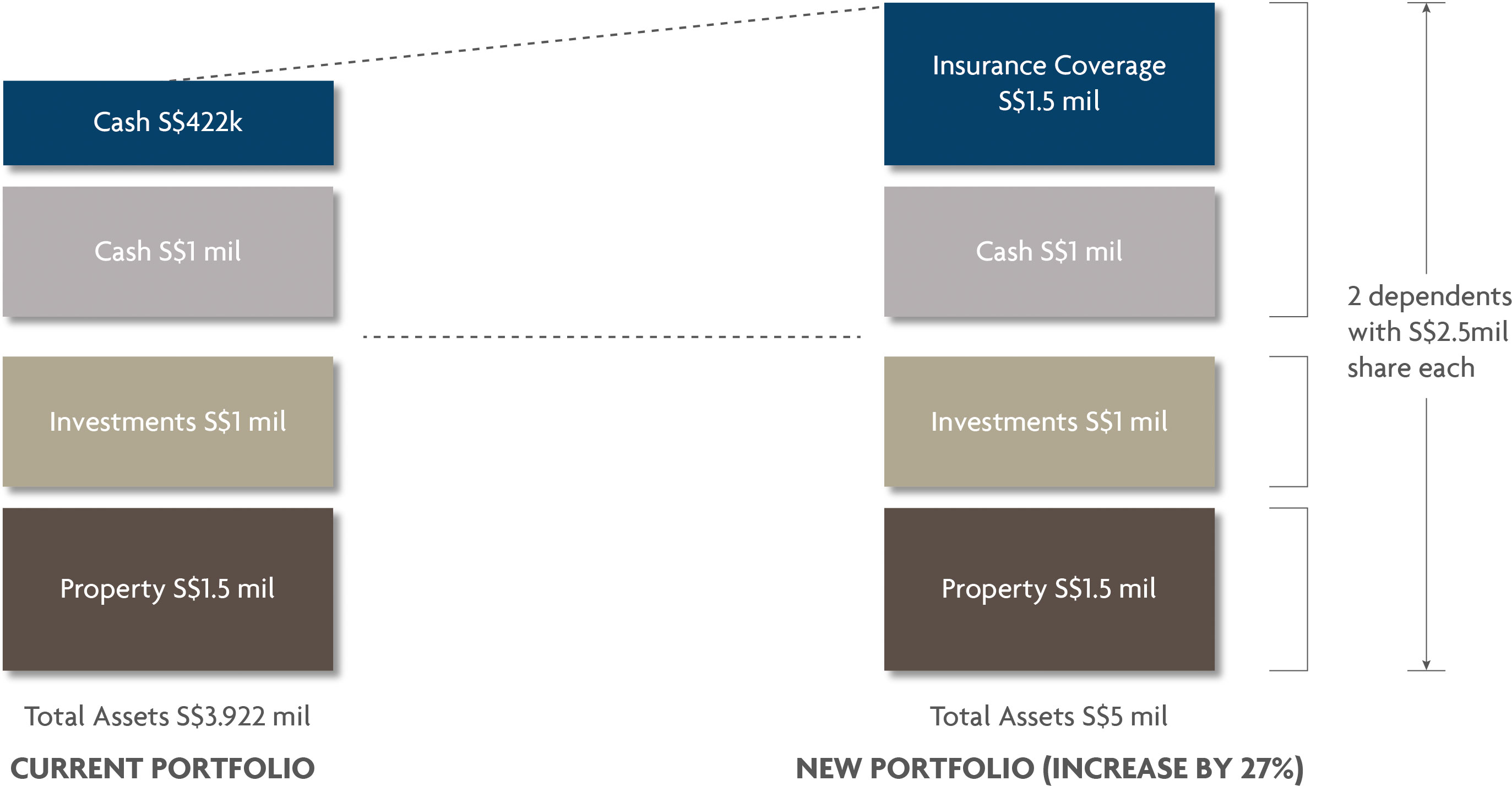

UOB's solution for Mr Tan

Through proper legacy planning, Mr Tan's estate can be evenly distributed among his two children without having to liquidate his asset holdings.

*Insurance premium quoted is based on PruLife Vantage Achiever II (SGD) for Male, Age 50 and Non-smoker. Figures provided above are for illustrative purposes only. Policy terms and conditions apply.

Suitable for:

Individuals with portfolios of diverse asset types (Investments, Properties, Business, Cash etc.)

|

Call our 24-hour UOB Wealth Banking Hotline at 1800 222 1881 (Singapore) or +65 6222 1881 (overseas) |

|

Speak to your UOB Relationship Manager |